Success in finance requires not only a deep understanding of financial concepts but also the ability to apply them effectively. One tool that has become indispensable in the world of finance is Microsoft Excel. Excel is a powerful spreadsheet software that can be used for a wide range of financial tasks, from data analysis and financial modeling to budgeting and forecasting. As a result, Excel courses have become increasingly popular among finance professionals looking to enhance their skills and advance their careers. In this article, we will explore what are excel courses useful in finance, their practical applications, and address some frequently asked questions. By the end of this article, you’ll have a clear understanding of how Excel courses can contribute to your business career branding and financial success.

The Significance of Excel in Finance

Excel has long been a staple tool in finance, and for good reason. Its versatility and ease of use make it an essential asset for professionals in various finance-related roles, such as financial analysts, investment bankers, accountants, and more. Here are some key reasons why Excel is so significant in the world of finance:

1. Data Analysis and Visualization

Finance professionals deal with vast amounts of data on a daily basis. Excel’s data analysis and visualization capabilities allow them to process, organize, and present financial data in a way that is easy to understand. This is crucial for making informed decisions and communicating financial information effectively to stakeholders.

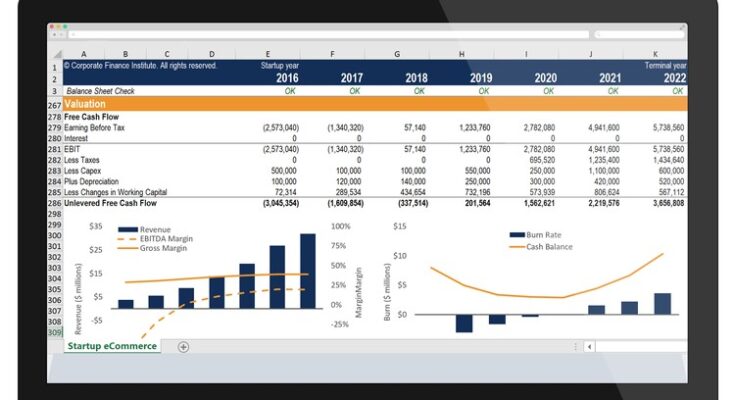

2. Financial Modeling

Financial modeling involves creating mathematical representations of a company’s financial performance. Excel’s powerful formulas and functions enable professionals to build complex financial models for scenarios like forecasting, valuation, and investment analysis. This is essential for strategic planning and decision-making.

3. Budgeting and Forecasting

Budgeting and forecasting are critical aspects of financial management. Excel’s ability to perform what-if analysis and scenario planning simplifies the process of creating budgets and predicting future financial outcomes. This aids in resource allocation and risk assessment.

4. Automation and Efficiency

Excel allows finance professionals to automate repetitive tasks, which can save both time and effort. From automating data entry to creating dynamic reports and dashboards, Excel streamlines workflows, making professionals more productive.

5. Standardization and Consistency

Excel provides a standardized platform for financial analysis, ensuring consistency in reporting and data manipulation. This is particularly important for regulatory compliance and maintaining data integrity.

6. Communication and Collaboration

Excel makes it easy to share and collaborate on financial data and reports. Professionals can use it to create clear, concise, and visually appealing presentations and reports to convey complex financial information to a wide audience.

Excel Courses for Finance Success

While Excel is a valuable tool in finance, harnessing its full potential often requires specialized knowledge and skills. Excel courses are designed to bridge this gap by providing professionals with the training they need to excel in their finance careers. These courses come in various formats, from online self-paced programs to in-person workshops. Here are some essential Excel courses for finance success:

1. Excel for Finance and Accounting

This foundational course is tailored to finance and accounting professionals. It covers the basics of Excel and gradually progresses to more advanced topics, such as financial modeling, budgeting, and forecasting. Participants learn to create financial statements, perform ratio analysis, and build comprehensive financial models.

2. Advanced Excel Functions for Finance

This course delves into the more complex and specialized Excel functions used in finance, such as NPV, IRR, and the VLOOKUP function. Participants gain a deep understanding of these functions and their applications in various financial scenarios.

3. Financial Modeling with Excel

Financial modeling is a core skill in finance, and this course focuses exclusively on creating detailed financial models. Participants learn to build models for valuations, mergers and acquisitions, and investment analysis. The course emphasizes real-world applications and best practices.

4. Data Analysis and Visualization with Excel

Effective data analysis and visualization are essential for decision-making. This course teaches participants how to use Excel’s data analysis tools, pivot tables, and charts to extract insights from financial data and present them in a compelling manner.

5. Excel VBA for Finance Professionals

For those looking to automate financial tasks and processes, Excel VBA (Visual Basic for Applications) is a valuable skill. This course provides an introduction to VBA programming and its applications in finance, including creating custom functions and automating financial models.

6. Business Intelligence and Reporting with Excel

Business intelligence is a crucial aspect of modern finance. This course covers the use of Excel for creating interactive dashboards, reports, and scorecards. Participants learn how to connect Excel to external data sources and use Power Pivot and Power Query for advanced data analysis.

7. Online Finance Certifications with Excel Focus

Numerous online certifications cater to finance professionals, and many of them include Excel as a significant component. These certifications often encompass a broader range of financial topics, with a strong emphasis on practical Excel applications.

FAQ: Excel Courses in Finance

Q1: Do I need prior Excel experience to enroll in these courses?

Most Excel courses in finance are designed to accommodate learners with varying levels of experience. While some courses cater to beginners and start with the fundamentals, others are more advanced and assume a basic understanding of Excel. You can choose a course that matches your skill level.

Q2: Are online Excel courses as effective as in-person training?

The effectiveness of an Excel course largely depends on the quality of the content and the learning environment. Online courses can be highly effective if they are well-structured and offer interactive learning experiences, including video tutorials, practice exercises, and instructor support. In-person training may provide more immediate feedback but can be less flexible in terms of scheduling.

Q3: How long does it take to complete an Excel course?

The duration of an Excel course can vary significantly, ranging from a few days for intensive workshops to several weeks or even months for comprehensive certification programs. The time required depends on the course’s complexity and the learner’s prior experience with Excel.

Q4: Are there free resources available for learning Excel for finance?

Yes, there are free resources available, such as online tutorials, YouTube videos, and Excel community forums. However, paid courses often offer a more structured and comprehensive learning experience, including support from instructors and the opportunity to earn certifications.

Q5: What are the career benefits of completing Excel courses in finance?

Completing Excel courses in finance can provide numerous career benefits, including:

- Improved job prospects and increased employability in finance-related roles.

- Enhanced skills in data analysis, financial modeling, and reporting.

- The ability to tackle complex financial problems and make more informed decisions.

- Opportunities for career advancement and higher earning potential.

- The ability to excel in a competitive job market by demonstrating proficiency in a critical tool.

Also Read: Excel Courses for Accountants

Conclusion

Excel courses play a vital role in the career branding of finance professionals. They provide the knowledge and skills necessary to harness the full potential of Excel for various financial tasks, from data analysis and financial modeling to budgeting and forecasting. Excel is not just a spreadsheet tool; it’s a strategic asset that can significantly contribute to your success in finance. By mastering Excel through targeted courses, you’ll be better equipped to make data-driven decisions, communicate financial information effectively, and stand out in a competitive job market.

Whether you’re a finance novice looking to build a solid foundation or an experienced professional aiming to refine your Excel expertise, there’s a course tailored to your needs. Invest in your financial future by considering Excel courses as a crucial component of your career development and brand enhancement. With the right training, you can excel in the world of finance and enjoy a successful and fulfilling career.